July 22nd, 2014.

8 Great Areas for Commercial Property Investment in the UK

As a property investor it can be very difficult to choose an area to buy commercial property.

There are many factors that can influence how the price of the property will inflate and the amount of rent you could charge prospective tenants.

To make finding the perfect area to invest slightly easier for you, we’ve put together a list of eight locations that look set to be great investments and why:

#1 Gatwick

[Image: Chris Sampson under CC BY 2.0]

Why: In the latest government investment policy it was announced that £50m will be spent on redeveloping Gatwick Airport’s train station. There is also a campaign which is currently working to have another runway being added to this airport, which would allow for more flights to come in and out of this airport every day. While this may not be great news for residents, it is excellent for property investors as offices and hotels are sure to benefit from this project.

#2 Battersea

[Image: David Samuel under CC BY-SA 3.0]

Why: Anywhere is London is bound to be a strong investment, however sky high prices can make it unaffordable or not-profitable enough for many investors. Buying on the outskirts has always been a good strategy and with the confirmation of a £1bn extension to the Northern Line all the way to Battersea, property in this location will be in high demand.

#3 Felixstowe, Suffolk

Why: Felixstowe is already a very important port which sees millions in goods passing through it every day. That alone makes it a great place to develop warehouses or business developments, but thanks to the planned improvements to the A14 and surrounding infrastructure it will only get better. You may not receive the same prices for developments here that you would from London, but the returns on rent can be extremely rewarding.

#4 Super-Connected Cities

Why: Whether it’s for residential development or commercial property acquisition, Super-Connected Cities are the places to be. Everyone wants faster broadband speeds and any of these cities offer a great place for online businesses, ecommerce and IT companies to establish themselves. Out of the cities receiving this development, Brighton and Hove, Manchester, Newcastle, Aberdeen, Cardiff and Belfast stand out as good investments.

#5 Birmingham

[Image: West Midlands Police under CC BY 2.0]

Why: Not only is it the third largest city in the UK, but with a fast speed train line being put in between Birmingham and London it is likely to expand even further. In addition to this, it is also set to be a Super Connected City making it even more appealing to businesses.

#6 Glasgow

[Image: John Lindie under CC BY 2.0]

Why: Glasgow is a particularly desirable area for businesses that need a lot of floor space due to the low cost of land. This makes it an ideal place to develop large office blocks, but believe it or not you can receive the best rental return on residential buy-to-let properties in the UK here. Average monthly rent for a four-bed house is around £1,100 with the average house price being £262,888 which can give you a gross annual yield of almost 5%.

#7 Cambridge

[Image: Solipsist under CC BY-SA 2.0]

Why: Since the 2008 recession, Cambridge has made the fastest and greatest recovery in development outside of London. This trend seems set to continue, so finding property for a low cost on the outskirts of Cambridge could be a very strong investment for the future. Finding out other areas which are recovering fast is also an excellent way to turn a profit.

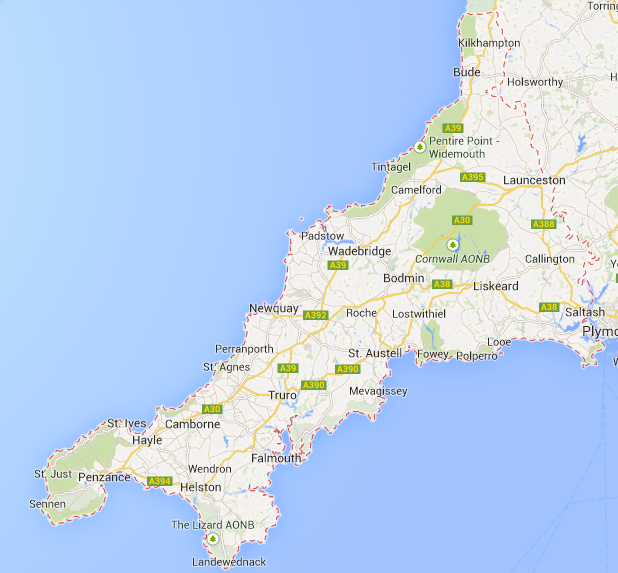

#8 Cornwall

Why: Residential development in this area is in strong demand whereas the land is still comparatively cheap, allowing you to maximise profits with each sale. There are lots of possibilities here, from buy-to-let accommodation down, and from holiday home developments all the way up to large warehouse and office spaces. Any property investor worth their salt should already have looked into getting a commercial investment mortgage to start taking advantage of this area.

Even if you find the perfect location for commercial investment, without the right financing you could see your profits dwindling. By using a commercial mortgage broker you can maximise your profits by receiving the best rates and a package that is completely tailored to your needs.

Talk to us today to find out more about how we can help you make the most from your investments.