October 3rd, 2017.

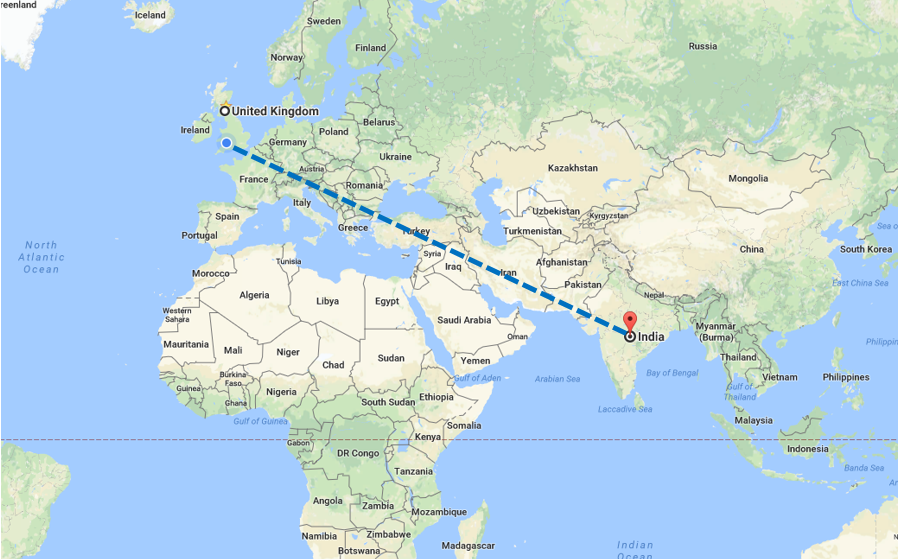

Deal of the Month: Bridge Secured Despite the Borrower Being 5,000m Away

Sometimes lenders can be reluctant to lend to foreign nationals as the UK is not their main country of residence, that is why we’re especially proud of the hard work our team put in to make this deal a success.

October’s ‘Deal of the Month’ saw two clients approach us for bridging finance after they had been referred to the Pure team by their mortgage broker due to the complexities of their case.

The clients required a gross loan of £889,000 over a nine-month term that would be secured against the site of their previous business. This would be used to purchase a large ten-bedroom house, as well as an executive flat in Canary Wharf, and this would re-bridge their finances after a previous exit of a bridging loan failed when the sale of their property fell through.

As both parties were foreign nationals and one of the clients would be in India whilst the bridge loan was going through, anyone other than a specialist finance broker may not be able to find a lender. However, thanks to the experience of the Pure Commercial Finance team and the great relationships we have with lenders, we were able to complete the deal.

Do you require a bridging loan, but have complicated circumstances? Then our specialist commercial finance brokers may be able to help. Discuss your bridging finance requirements with a member of the team today by calling 02920 766 565.

Read more:

Deal of the Month: Quick Finance for an Auction Property Purchase

Everything You’ll Need to Get a Bridging Loan

What Can a Bridging Loan Be Used for?