July 16th, 2019. Jamie Williams

Everything You Need to Know About the New-Build Leasehold Ban

Leasehold properties have made headlines for all the wrong reasons over the past few years, but now the government has issued an official response against them. For those who don’t know, a leasehold means you own the property but not the land it sits on. While this is useful for properties like flats, it has, in the view of many, been used exploitatively against first-time buyers.

The government has started a “move to tackle unfair leasehold practices and prevent future home-owners from being trapped in exploitative arrangements”. In its view, leaseholds that have been sold to first-time buyers have kneecapped them with unfair fees and penalties.

Now, the government has instituted a new-build leasehold ban to curb its rise. Below, we list all you need to know about the most recent ban, as well as the effects it is already having on property development and its associated finance.

What Does The Ban Actually Say?

News of the ban began with a speech at the Chartered Institute of Housing conference by James Brokenshire, Secretary of State for Housing, Communities and Local Government. Brokenshire confirmed that the government has plans to abolish leaseholds on new-build properties, alongside a promise to reduce current ground rents for leases to zero. This means almost all property will be new-build freehold.

Another introduction will be a new time limit of 15 working days with a maximum charge of £200 for freeholders and agents to provide homeowners with information to sell their home. Recently, there’s been cases of the former holding onto information to increase fees.

The ban will also impact the Help-to-Buy scheme, as ministers will push for banning the sale of new leasehold properties for those on the scheme except for in “exceptional circumstances”. No indication of what these circumstances are yet though.

If a leasehold is sold by mistake, then the homeowner will automatically be changed to freehold with no cost or charge.

Overall, the ban looks to erase leasehold properties for first-time and new-build buyers, instead opting to facilitate the further dominance of freehold.

How Has The Housing Marketing Reacted?

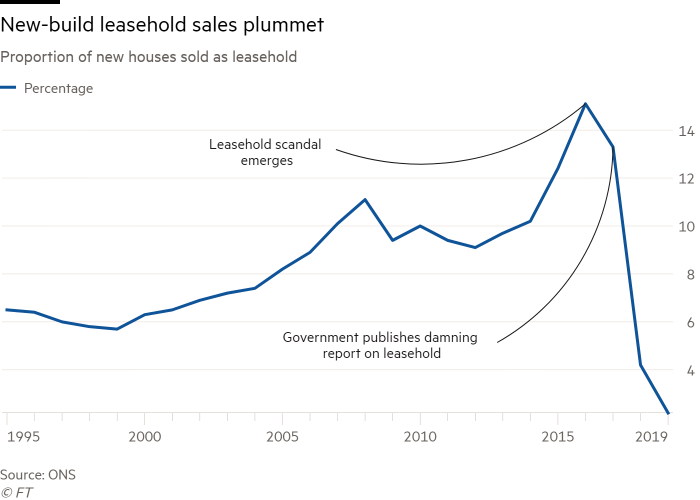

Since the leasehold scandal broke three years ago, leasehold properties have declined sharply. Only 4.2% of properties sold last year in England and Wales were leasehold compared to 13.3% in 2017. For new-build homes, the figure has an even larger drop to 0.8% in May from its 17.5% peak in January 2017.

As such, the reaction to this bill in the housing market has already occurred. As soon as the scandal broke in 2017, government intervention was expected, thus leading to a proactive reaction in the market. Since the scandal broke, the question as to when will leasehold be banned was more ‘when’, not ‘if’.

The Future of Leasehold

For the most part, the future of freehold and leasehold appears to be a dichotomy governed by the property type; leasehold will likely be reserved for flats and other niche uses, with freehold for complete homes. The days of putting a leasehold on an entire home seem to be at an end, but the leasehold model still suits those who wish to purchase a flat.

However, the majority of issues with leasehold only extends to residential property. Commercial property has been relatively stable, so attaining a commercial plot on a leasehold basis is still a solid choice.

Worried About Leasehold?

Pure Commercial Finance is made up of an experienced team of brokers who know the ins-and-outs of property development finance. We can help you make the most of a secured loan or simply provide advice on where to invest and how to negotiate the muddy waters of leasehold property.

Article By Jamie Williams

July 16th, 2019

Jamie Williams is an integral part of our specialist finance team. He is an expert in bridging and development finance, as well as commercial and second charge mortgages.

With over 17 years experience in the mortgage and specialist finance world, Jamie uses his unrivalled knowledge to provide the ultimate client experience.

See more articles by Jamie