November 19th, 2020. Mark Hughes

Is Affording a First Home Deposit Harder Than Ever Before?

Since the Coronavirus pandemic first broke in early 2020, lenders have become stricter with borrowing and many high street banks have paused the availability of 95% mortgages. Many first-time buyers are now claiming this is making getting onto the property market harder than it has ever been before.

What Does Data Reveal About the Average Deposit for First-Time Buyers?

The Guardian recently reported that three in ten young households in the UK do not earn enough to pass lenders’ affordability checks for an 85% mortgage. The research carried out with Hamptons International compared average property prices across the UK and found that the average first-time buyer would now need a household income of £37,096 to get a mortgage with a 15% deposit.

Making the assumption that these households would be made of two full-time working people, the paper claims 70% aged 22 to 29 years old would be able to achieve that income level. However, they would still need to raise a deposit of £29,458 to afford the average starter home.

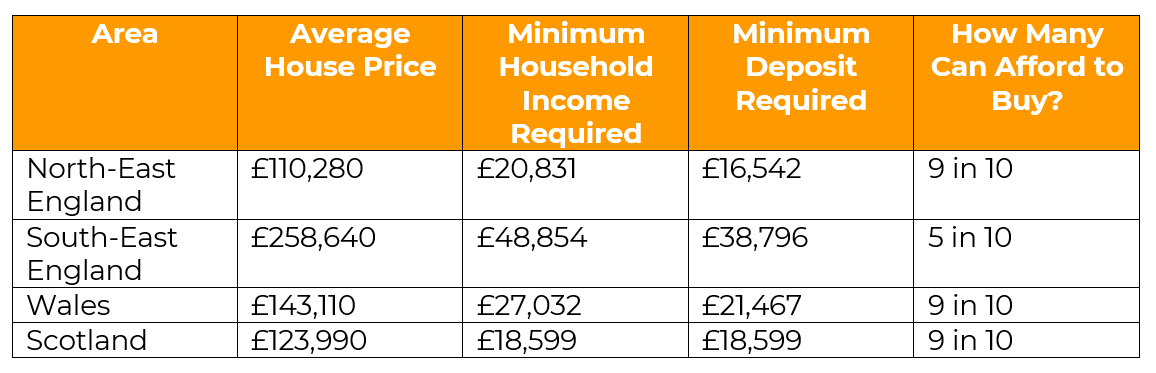

Looking at different areas of the UK in greater detail, it was revealed that affordability varies greatly.

Although unlikely, should a first-time buyer decide to purchase in one of the UK’s most expensive counties, Kensington and Chelsea, the average property costs £1.1m. A property purchase of this value would require a deposit of £112,526 and household earnings of £225,052 – with both of these figures higher than the average property price in some parts of the UK.

““For first-time buyers with smaller deposits, getting a mortgage is becoming harder by the day, and the natural escalation of renters to buyers looks set to be disrupted until lenders regain confidence and become more comfortable again at higher loan-to-values. The result will be increased demand for rental property, which will almost certainly mean upward pressure on rents in the months ahead, just as the full impact of Covid-19 on the economy starts to bite. The winter looks set to be a challenging one for first time buyers and tenants. In the meantime, landlords are likely to continue to take advantage of the situation. To achieve their goal of getting onto the property ladder, tenants will need to become savvier with their planning and more streetwise with their choices than ever." ”

RenterBuyer

Olu Olufote

Chief Executive

We Can Source Your First Time Buyer Mortgage

If finding property finance has been difficult for you, then give us a call. Our experts have strong relationships with lenders both on and off the high street and can customise your loan application, so you appear as desirable as possible.

Being a first-time buyer can appear daunting, but it doesn’t have to be. Let our experts do the hard work for you and make purchasing your home a more enjoyable experience. Get in touch today.

Article By Mark Hughes

November 19th, 2020

Mark has 15 years’ experience within the financial industry working for high street banks and specialist brokers and now focuses on Bridging finance and Second charge loans.

He would describe his style of brokering as being heavily based on knowledge and efficiency.

See more articles by Mark