January 23rd, 2019.

House Prices 2019: What Will Brexit Do to the Property Market?

The Brexit effect on house prices is the hot topic of the moment, with less than 100 days to go. So, I decided to take a look at long and short house price predictions, and how this will influence both sales and lending.

What Does the UK’s Exit Mean for House Prices After Brexit?

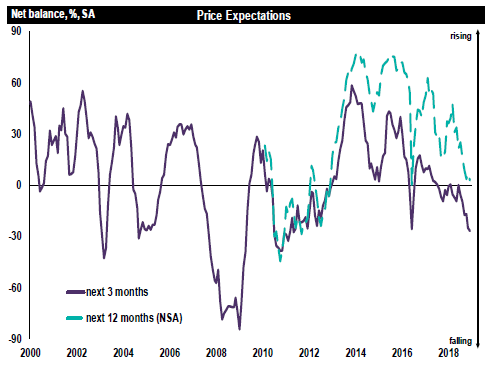

If you’ve read the news stories, you have probably heard that some surveyors are expecting the worst outlook for 20 years. A net balance of 28% of Royal Institution of Chartered Surveyors (RICS) members said they expect property sales to fall in the next three months.

This is explained by the drop-off of buyer interest and a lack of fresh properties coming on to the market in a period of uncertainty around the UK’s exit from the European Union. Many also blamed stamp duty demands.

Simon Rubinsohn, RICS chief economist.

“It is hardly a surprise with ongoing uncertainty about the path to Brexit dominating the news agenda, that even allowing for the normal patterns around the Christmas holidays, buyer interest in purchasing property in December was subdued.

“This is also very clearly reflected in a worsening trend in near-term sales expectations.”

According to the Office for National Statistics (ONS) and Land Registry data, house prices have stagnated. In its latest release from the end of 2018, the average house price in the UK was just over £230,000. This was 0.1% lower than the previous month, but up 2.8% on the previous year.

So, what does all of this mean for developers and investors? Well, this could mean increased difficulty when trying to sell a property following development. Long-term, this will lead to an extension of sale periods so there is no rush to sell properties in the current climate. It could also lead to housing crisis-related government build targets not being met.

There is some good news though. The December RICS report suggested the number of sales in East Anglia, Wales, the North East and Northern Ireland may see positive change, and that the more pronounced effects on London and the South East should lessen after a few months.

As Rubinsohn continued:

“Looking a little further out, there is some comfort provided by the suggestion that transactions nationally should stabilise as some of the fog lifts, but that moment feels a way off for many respondents to the survey.”

(source: RICS)

What Does This Mean for Finance?

It may become more difficult to secure finance in the months following Brexit as banks become more stringent with their lending criteria to avoid risk of redemption. However, at the moment, we’re seeing different finance products being influenced in different ways.

We’ve recently seen a rate battle break out among bridging lenders, and development exit finance is also beginning to fluctuate. Despite this, development exit finance will likely become even more popular in the year ahead as it allows borrowers to refinance completed developments at lower interest rates and free up equity for future activity.

If you’re looking for property finance of any kind in the coming months, we would recommend you getting in touch with our team to discuss your options. Some sites are currently underselling rates during this time of uncertainty, and our brokers can help find you a competitive deal that’s personalised to your needs.