January 22nd, 2021.

Historical Mortgage Rates UK: Where Are We Now?

How does the current interest rate compare when we look back, and are there any interest rate trends? Keep reading to find out more.

What Determines the Mortgage Interest Rate?

Though your mortgage interest rate will vary depending on the mortgage provider and product you choose, one important factor that determines mortgage interest rates is the Bank of England base rate.

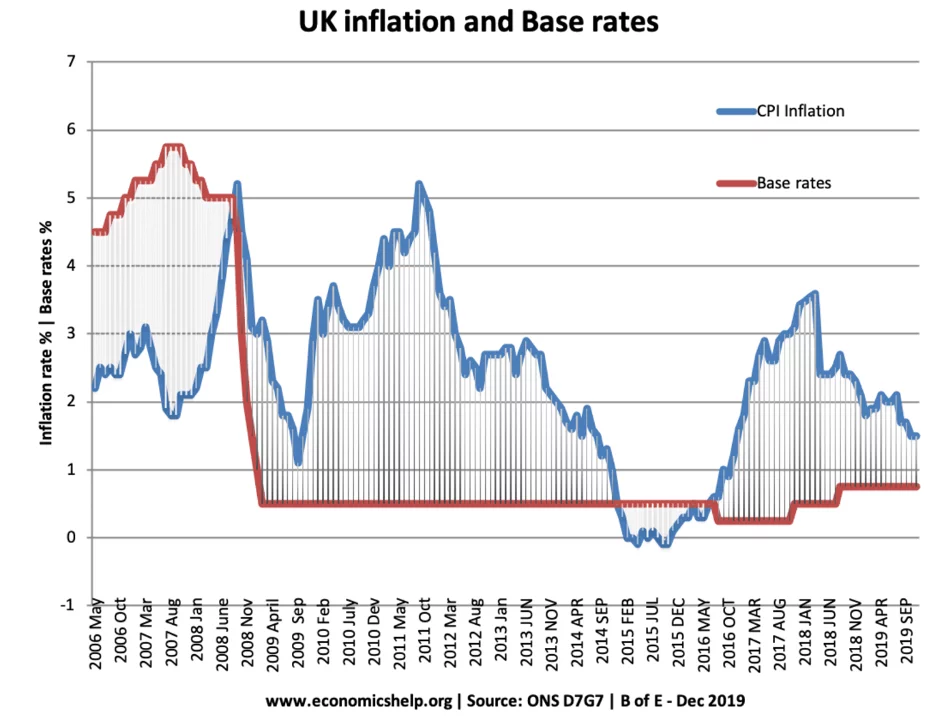

The base rate effects a range of financial products, from mortgages to savings accounts and pensions, and also affects the value of the pound. Set on the first Thursday of every month, the base rate is determined by looking at UK spending and how it is affecting inflation. In short, if spending is too high the rate will be increased, and to boost spending the rate is lowered.

What Is the Current Interest Rate for a UK Mortgage?

The current Bank of England base rate is 0.1%, a record low.

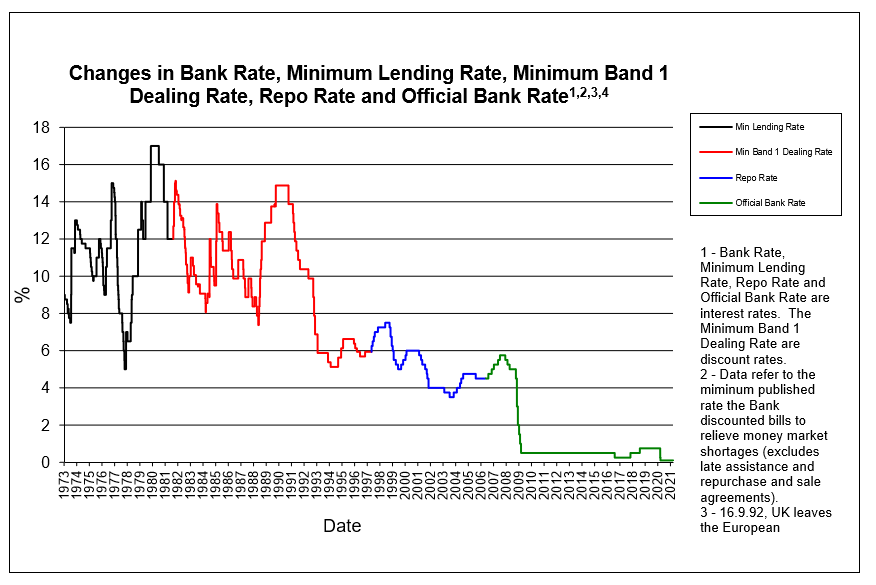

Source: Bank of England

At time of writing, the base rate sits at 0.1% and has done since March 2020 when we first went into lockdown early on in the Coronavirus pandemic.

The cuts, which have been introduced in response to the upheaval of the Coronavirus crisis, are bad news for savers who will be earning less from their nest eggs. However, the rates also represent a possible saving for borrowers. So, if you are considering buying a property, remortgaging or looking into development finance, now could be the right time.

What are the Historic Mortgage Rates in the UK?

Until July 2016, the base rate has remained stable at 0.5%. Between then and the Coronavirus outbreak, it dropped to 0.25%, rose to 0.75%, then dropped again to today’s rate. As a result, mortgage rates have been affected.

The highest the UK base rate has been in recent memory was 17% in the late ’70s, when rising wages and oil prices were causing a surge in inflation. However, the UK base rate was also very high in the early ’90s (in comparison with today’s rates) when it averaged around 15%.

On the flip side, some of the biggest drops were in 1992 when UK interest rates fell 9% on Black Wednesday and in 2008 when they dropped 5.25% due to the financial crisis.

The new 2021 decrease represents an unprecedented low for the base interest rate. As mortgage interest rates generally reflect that of the Bank of England Base rate, this means the interest you pay if you take out a mortgage in the current climate may also be unusually low.

What Does the Future Hold for the Average Mortgage Interest Rate?

With the base rate being at an all-time low, the only way is up. The question is, when? We have already seen a resurgence of the property market since the first lockdown in early 2020 and we predict further improvements as restrictions ease and we tip toe back towards ‘normal’ life, but will rates follow a similar pattern?

A Reuters poll revealed that these rates are expected to remain at 0.1% until at least 2024 to avoid negative borrowing costs.

What Does All of This Mean for You?

While the current low interest rate means you could save money on a mortgage, there are other factors to consider. Ongoing economic uncertainty has made lenders more risk-adverse, meaning it may be more difficult to obtain a mortgage if you:

- Have a low or minimum deposit.

- Are a first-time buyer.

- Are self-employed.

- Have started a new job very recently.

With this in mind, it’s more important than ever to consult a financial expert when seeking finance. Using an experienced property finance broker with knowledge of the market and up-to-date data on the latest products and fluctuations will help ensure you get a competitive mortgage offer that suits your specific lending requirements.

If you’re looking to finance a new project or are coming to the end of your term on an existing loan, give our commercial mortgage team a call. Alternatively, if you’re purchasing a residential property, our residential mortgage team can help. Get in touch!