November 29th, 2018.

How Stadium Investment Affects Property Prices in Surrounding Areas

Gentrification and redevelopment of local facilities – we all know it can work wonders for property prices. However, we’ve been thinking... besides the typical transport links, schools and green spaces, are there any other factors that can cause a surge in property prices? Perhaps the building or redevelopment of a major sporting stadium?

Learning from the Success of Past Stadium Regenerations

Did Stratford House Prices Increase After the Olympics?

One of the UK’s biggest developments in recent years is found in Stratford, East London. Once dominated by brownfield sites, it has now hosted some of the world’s best athletes thanks to the creation of the Queen Elizabeth Olympic Park.

Designed for the 2012 games, an athletes’ village and several sporting buildings were created, as well as an observation tower (which is now Britain’s largest piece of public art) and Westfield Shopping Centre. Alongside this, there are green spaces, a commercial district, and hundreds of new homes. The list goes on and on.

Halifax recently reported that property for sale in Stratford, especially the houses in postal districts nearest the London Olympic stadium, increased an average of £4,279 per month between September 2012 and the close of the Paralympic Games in April 2017. That means a surge of 64% in Stratford property prices from £286,683 to £470,487.

With West Ham moving into the stadium in 2016, the development site is now furtive ground for property development.

Has this transformative effect happened with other stadiums? Let’s take a look at a few others.

What Did the Emirates Stadium Do for Holloway Property Prices?

Completed in 2006, the Emirates Stadium is home to Arsenal and is the third biggest football stadium in England.

The stadium is designed by Populous, constructed by Arcadia, and consists of a four-tiered bowl with translucent polycarbonate roofing over its stands, allowing shelter from weather but maximum airflow and sunlight for the pitch.

Deemed ‘beautiful’ and ‘intimidating’ by Populous architect Christopher Lee, the Emirates Stadium has significantly transformed Holloway N5, in North London, since the site was bought in 2000. What was previously an industrial and waste disposal centre has seen the area go from strength to strength.

In January 2006, the year the stadium opened its doors, the average property price in N7 was £262,902 and the following year saw a considerable jump in the number of sales in the area. Ten years later the average property price in N7 has more than doubled to £618,647.

Though, is this rise all down to the building of the stadium? Well, that’s something economists Gabriel Ahlfeldt and Georgios Kavetsos sought to find out. In an in-depth piece of research, they analysed house prices around the Arsenal stadium and found property prices began to rise as early as 1999 when plans for a new stadium were first rumoured. They also found a rise which correlated with the final decision on the site of Arsenal’s stadium.

The economists concluded that inflation could not explain the rises, nor could improvement to local transport facilities. Coincidentally, they found that property prices near the old Highbury stadium location slowed.

Kavetsos and Ahlfeldt said:

“The effect was highest very close to the stadium and diminished gradually with distance until disappearing at a distance of about 5km.”

Was There a Similar Effect Created by the Etihad Stadium in Manchester?

(image: Manchester City)

Originally built to host the 2002 Commonwealth Games, the Etihad Stadium is home to Manchester City.

The stadium was built by Laing Construction and designed and engineered by ArupSport, who transformed a brownfield site 1.6km east of the city centre. This plot had previously been the site of Bradford Colliery, but had been derelict for some time.

With its rich sporting history over the last 25 years, it would be easy to assume a strong property market. And, Land Registry price data certainly supports this as it reveals between 1995 and 2016 property prices in M11 3, near the Etihad Stadium, went up 718%.

In fact, from when the stadium opened until the end of 2007, the number of properties sold in the M11 area increased considerably, and so did the average price. In January 2002, the average property here sold for £20,640, by December 2007 this had risen to £121,283, and the average price now sits at just under £140,000.

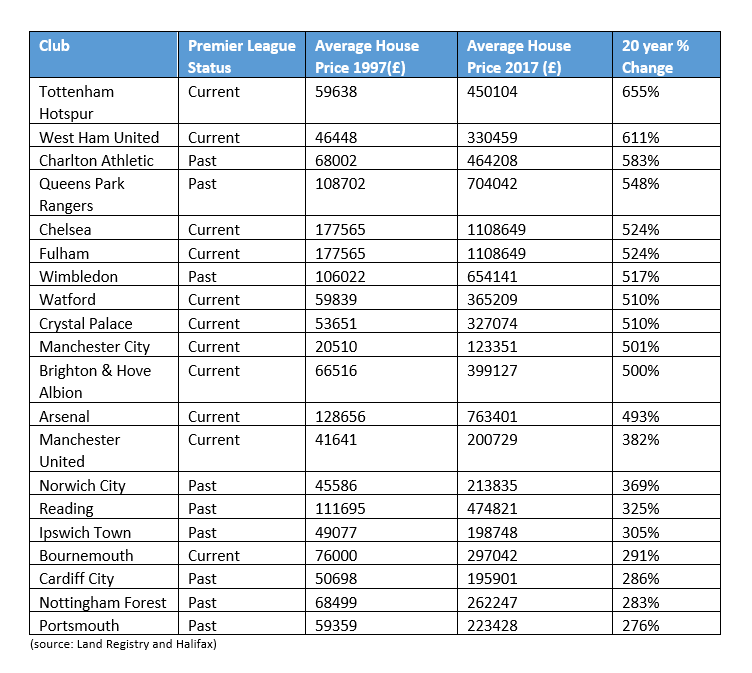

Highest % change in house prices of past and current Premier League teams over the past 20 years

Research by Halifax compared house prices over the last 20 years near past and present Premier League teams, and found an overall rise compared to the national average.

The average property in the UK cost £65,092 in 1997 and by August 2017 was worth £225,956 – an increase of 247.13%, a lower figure than all listed above.

Could Investing Now Make a Decent ROI?

With huge property price increases, as well as increased demand, seen in the areas surrounding stadiums in the noughties, could this return on investment be emulated elsewhere in the country today? Furthermore, could you highlight development opportunities by pointing out stadiums that are looking tired and in need of a refresh… or even rebuild?

That’s what we’ll discuss in the second half of this article, where we outline football stadiums currently under development and those that are starting to look tired.