April 3rd, 2023.

Second Charges to Spring to Life

After the anticipated surge of post-Christmas debt consolidation, the market has seen a dip in second charge enquiries.

In order to curb the drop, lenders across the board have started to reduce their rates.

We’re predicting a spike in enquiries by the middle of Q2 and our team remains poised to fulfil more of our client’s specialist lending needs.

Here’s why:

Debt consolidation

- The BoE base rate, last Friday, rose by just 0.25%, which is less than initially expected and thought to be the last rise for a while

- Lenders have lowered their stress ratings and their margins are levelling off – we’ve seen the highest market share reprice this week at 4.99%!

- Now could be the perfect time to consolidate high % rate debts, such as credit cards, overdrafts etc

Home improvements

- With the worst of the weather now behind us, more people will be undertaking home improvements for the spring/summer months

- Wider economic uncertainty means a lot of people are cautious to move or sell, meaning investing in your current property is a popular alternative

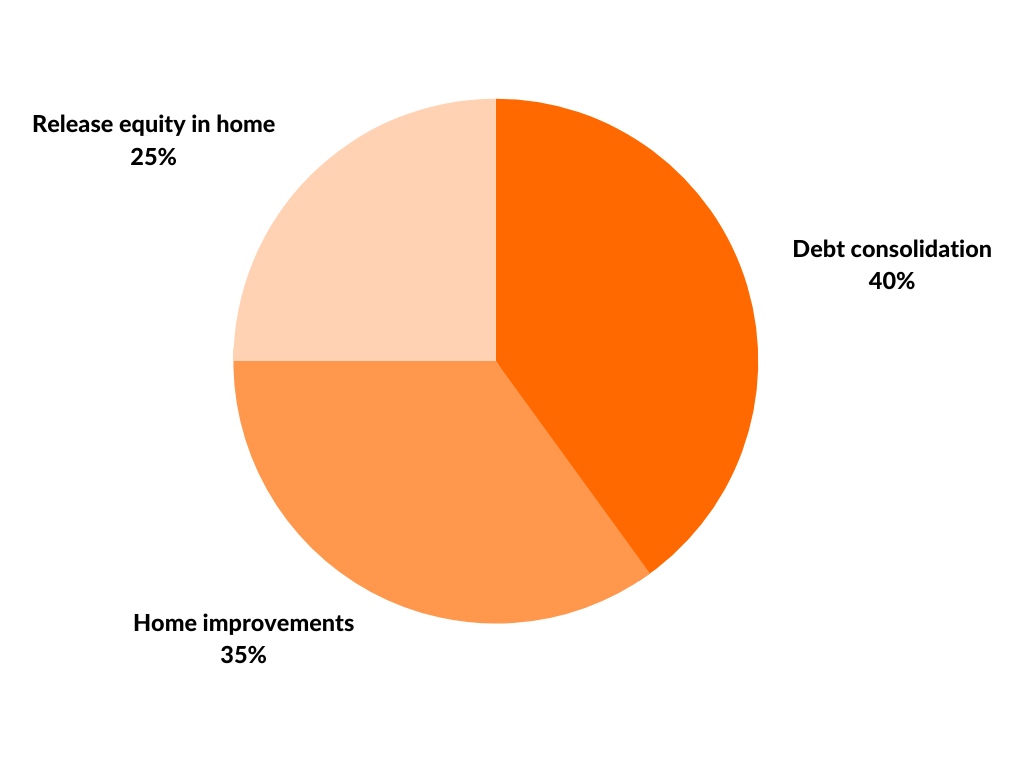

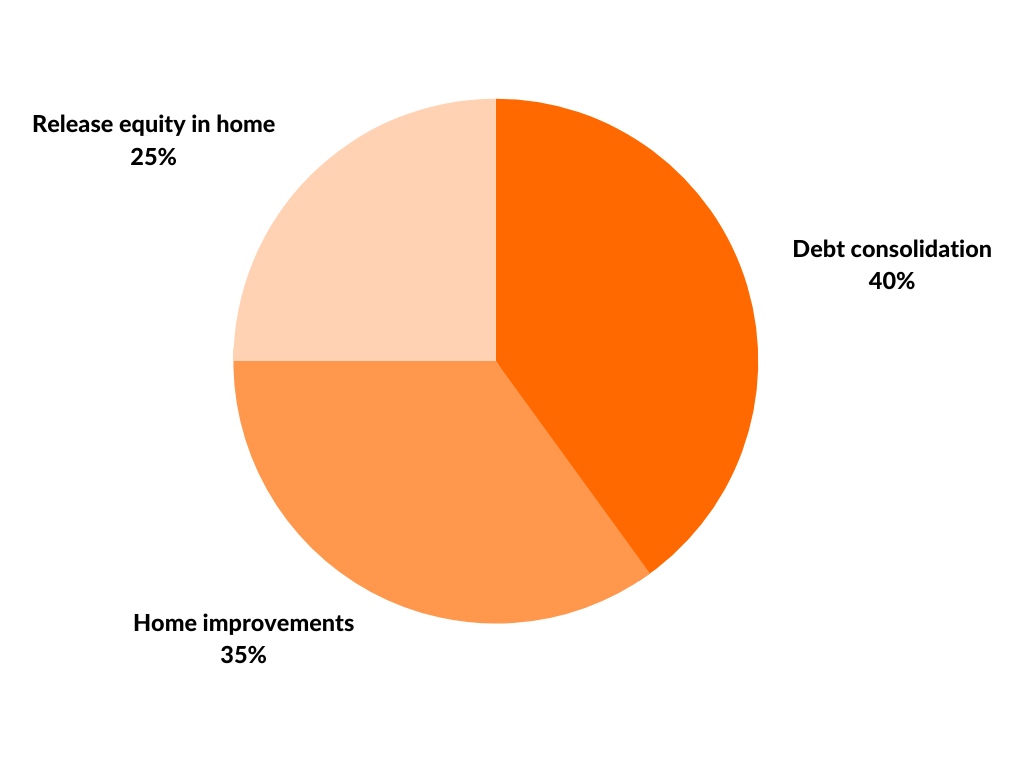

Our data supports this, as it shows the 3 biggest reasons people are taking out a second charge mortgage (or ‘secured loan’) are:

If you, or any of your clients, want to learn if a second charge is a good fit, call us on 02920 766 565 or by requesting a call back here.

If you, or any of your clients, want to learn if a second charge is a good fit, call us on 02920 766 565 or by requesting a call back here.