June 12th, 2018. Tom Rowlands

The Definitive Guide to Developing Student Accommodation and HMOs

There are now two students for every one purpose built bed space (PBBS) in the UK, with Portsmouth, Swansea and Brighton having some of the highest ratios on record according to Cushman & Wakefield. A fact that has seen some developers and institutions pour millions of pounds into student accommodation and HMOs. But, is your money safe in this kind of bricks and mortar? How does this compare to ‘normal’ buy to let developments?

In this definitive guide, our experienced property development and investment brokers discuss the current student accommodation investment market, highlighting key factors to consider when contemplating a development project for this sector.

This Guide’s Contents Include:

- The Top Transactions in 2017

- Choosing a Location to Invest in (Where Should You Develop Student Housing?)

- Student Housing vs. Traditional Buy-to-Let

- Where Are Student Housing Rents Highest?

- Taking a Closer Look at the Capital

- A Shift Away from HMOs Towards PBSA Developments

- Conclusion

The Top Transactions in 2017

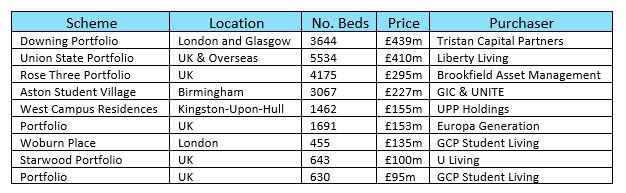

According to Cushman & Wakefield’s 2017 UK Student Accommodation Report, the top student accommodation transactions in 2017 were:

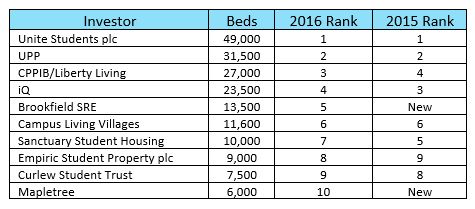

London clearly benefited from development more than anywhere else in the UK last year, but before this huge investment, few of these schemes were owned by companies that were top ten private sector property owners.

When compared to data from Savills World Research’s 2017 UK Student Housing Report, just Liberty Living, UPP, and Brookfield built upon their past successes as some of the largest private sector owners by number of beds with major developments in 2017.

Choosing a Location to Invest in

Where Should You Develop Student Housing?

To answer this question, the estate and lettings giant Savills has put together a student housing development league table which ranks UK cities’ development potential.

With Bristol, Birmingham, Manchester and Leeds all Red Brick Universities, and Oxford, Edinburgh, St Andrews Ancient Universities, it is unsurprising to see these university cities dominate Savills list for development potential. Since the introduction of higher tuition fees there has been a trend of students shifting their attention towards leading universities, and therefore property in the area has benefited as a result.

In fact, a recent report from One Touch has revealed that the universities in Bristol collectively have over 51,000 full time students enrolled, but only offer 7,000 beds. Therefore, there is increasing demand for PBSAs and developers are assured they will get an 8% net return over three years.

Whereas JLL reports London’s full-time student population is expected to rise by 50% over the next decade, which creates great demand for any newly developed accommodation.

Other lesser known university cities appear first most likely due to the opportunity to garner high yields in this less saturated market. Whereas some well-known university cities, such as Liverpool, have fallen down the ranks due to demand lessening after heavy investment in student accommodation in recent years.

Student Housing vs. Traditional Buy-to-Let

Why consider student property development over a traditional buy-to-let? Well, there are some clear benefits to investors:

• With multiple tenants, student properties typically garner higher rental yields (typically 8%+) and profit is made sooner than with a traditional buy-to-let.

• Student properties are generally hands-off and most landlords opt to go down the fully-managed investments route.

• Voids are extremely low compared to buy-to-lets, and contracts are signed months ahead of term times.

• Student investments offer higher rental growth opportunities.

Of course, with everything, there are some drawbacks too. The primary one being a restricted capital income compared to buy-to-let housing due to the limited number of investors in this part of the market. However, if you buy well, this should not be an issue.

Where Are Student Housing Rents Highest?

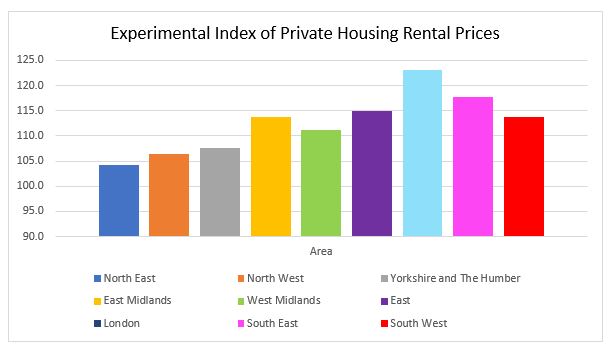

In March 2018, the Office for National Statistics released its latest Index of Private Housing Rental Prices which shows monthly rental estimates in Great Britain.

Unsurprisingly, London tops the list with the highest monthly rent as an extremely high demand area. With the South East and East with the second and third highest.

A complementary study by Accommodation for Students in 2017 found that the average rent for student accommodation in the UK can vary by up to £429 per week, with private halls of residence on average 90% more expensive than shared houses or flats.

The study concurred with the ONS data that showed the North of England as one of the cheapest places to live. It found the cheapest accommodation was in Stockton where it costs an average of just £60 a week, whereas the most expensive was in London Zone 1 at £489 a week.

Simon Thompson, director of Accommodation for Students said:

‘Although private halls are increasingly popular with students, the affordability factor remains a consideration for many. We have seen an increase of properties at both the low and high ends of the market.

‘This increased spread is likely to be due to both the introduction of more luxury student properties but also highlighting that there is still very much a place in the market for more affordable traditional student housing, as living costs and student fees continue to increase.’

Taking a Closer Look at the Capital

When it comes to choosing an area to develop in, there are a number of elements to consider. However, one of the most important is existing supply and demand.

According to JLL’s 2017 London Student Housing Report, London is the world’s largest student market, with more than 300,000 full-time students, around a third of which are international students. Yet, the Zone 1 development pipeline has fallen from 6,888 beds in 2014/2015 to just 1,519 beds in 2017/2018 due to high development costs and restrictive planning policies – the lowest it has been in more than a decade.

Read more: Revealed: The Easiest (and hardest) Places to Get Planning Permission in England

Therefore, it remains an undersupplied market. In fact, London is undersupplied by around 35,000 beds according to recent provision rates, and universities are heavily relying on the private rental community as a result.

A Shift Away from HMOs Towards PBSA Developments

Across the Severn Bridge in the Welsh capital, there is an altogether different student accommodation conundrum as the council has placed planning restrictions on HMO development.

Traditionally, rows of terraced houses in Cardiff areas Cathays and Roath were snapped up and transformed into HMOs. In fact, apart from university supplied accommodation for first year students, the student and young professional rental market here was dominated by these older residential properties.

However, years of student influences in these areas has encouraged the council to take action in a bid to address waste, increased noise and anti-social behaviour.

As a result, in recent years there has been a shift towards more modern high-rise buildings with the creation of multiple purpose-built student accommodation developments.

The Vice Chairman and Director for Wales of the Residential Landlords Association, has been vocal about this change. He recently told Wales Online:

“Strong university cities like Cardiff provide a regular, consistent and highly reliable source of tenants. Good universities attract better quality tenants, especially overseas students, that are often (not always) wealthier as the higher fees they have to pay compare to local students will often rule out others coming to the UK in the first place.

“They are also more likely to pay a premium for their rent for a hotel-style property and are more attracted to living alone or in small units as they tend not to know anyone when arriving in the country.”

“There are now two distinct markets for student accommodation in Cardiff, the traditional student housing market mostly in Cathays and Roath and the purpose built student accommodation mostly based in the city centre.

“These tend to attract different markets with the overseas students being attracted towards the more expensive hotel style purpose built student accommodation and UK students tending to be attracted towards the larger student houses in Cathays and Roath.”

Since 2015, 21 major developments have either been considered permission, begun construction or opened their doors in Cardiff. 13 of which are within 250 metres of each other, and are privately owned and managed exclusively for students.

If all are granted permission and built, that would mean more than 4,000 additional beds in purpose built student accommodation developments just a short walk from the city centre. Not counting the 3,000 or so that are tied to the new bus station development. That would equal around 7,000 new student-ready beds in little over three years.

The appeal is obvious: easy to manage blocks with substantial returns (much simpler than multiple HMOs) and more freedom around planning in a city with three universities.

Read more: Is Planning Permission Being Granted in Areas That Need It Most?

Conclusion

A number of lenders are now seeing student housing as a secure sector due to the high demand in certain cities, therefore higher loan to value rates are being seen at more affordable finance rates than in the past.

As our MD, Ben Lloyd states:

‘We have seen a steady rise in the number of people in the last 18 months looking to build purpose-built student living most notably high-density schemes. It would seem that developers and institutions alike have been specifically targeting cities and universities with a known under supply in the housing to student ratio.

‘From a funding perspective we have found the appetite to back these schemes is very strong, especially in core cities with multiple or large universities.’

If you’re looking at student housing development opportunities or HMO investment properties and require project funding, get in touch with our experienced commercial property finance brokers.

Article By Tom Rowlands

June 12th, 2018

Tom joined Pure Property Finance in 2017 after a career as a Client Wealth Manager, where he spent just under 3 years advising on financial and tax planning. Tom specialises in bridging finance and property development funding, having completed deals ranging from a simple £30K property purchase through to £2m+ mixed-use developments.

See more articles by Tom