December 21st, 2022.

Your Monthly Mortgage Could Rise £250 by Next Year

The Bank of England has stated that around 4 million homes will have higher mortgage rates, with an expected rise of £250 each month.

On average, each person’s monthly mortgage bill will go from £750 to £1,000, according to the Bank’s Financial Stability Report.

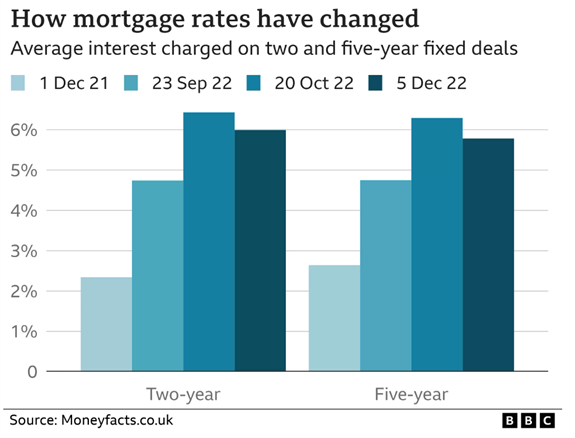

Fixed-rate mortgages, as the name suggests, have a set rate of interest for the duration of the deal – which is typically 2 or 5 years, though longer ones are available.

Anyone approaching the end of their fixed deal and seeking a new one, or first-time buyers taking out a mortgage for the first time, would have seen an increase in the cost of such loans.

As a result of the Bank putting up interest rates to combat inflation, fixed-rate deals have shot up throughout the year, peaking at 6.65% following the mini-budget.

Since the Chancellor’s Autumn Statement, however, things have stabilised and are beginning to decrease, easing uncertainties for lenders and borrowers alike.

Within 3 years, it is predicted that 70% of all mortgage holders will see an increase in their payments.

As we stated in our last email, property prices have seen their sharpest downturn, falling for the last 3 months in a row.

Those with buy-to-let properties have been particularly susceptible, as 85% of their mortgages were interest only, meaning they’re sensitive to the rise in borrowing costs.

This means landlords would either need to sell their investment properties or raise rental income by 20%, causing a further fall in the cost of properties.

To discuss your current financial situation and if specialist lending (including first charge mortgages) can help, call us on 02920 766 565, or request a call back HERE.