(Source: This is Money)

“What goes up, must come down,” said the great Sir Isaac Newton when describing the law of gravity.

This same law in the world of physics holds true in the world of property investment. It’s a law that property investors have taken advantage of for centuries in acquiring premium properties at discount prices. And it’s a law that dictates that you prepare for it in advance in order to benefit from it.

Why?

Because in the world of property investment, the other side of the coin is that what comes down will go up.

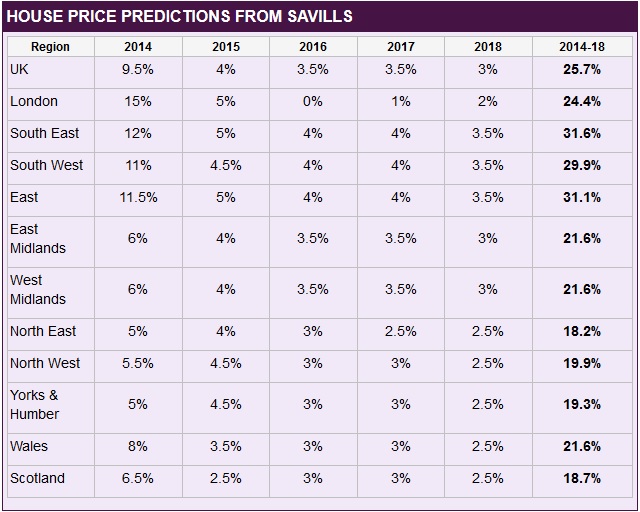

And this is especially true in today’s economic climate. According to statistics from Savills, a leading international estate agent, house prices are set to increase by 26% over the next 5 years … as well as flat-line in certain areas.

The driving force behind this increase in house prices is a combination of record low interest rates, rising loan-to-income lending and sky high demand from buyers re-entering the marketplace as the economy strengthens.

So the question then becomes: how do property investors take advantage of this increase in prices over the next 5 years?

Good question. And to answer it we need to look at the specific forecast figures for the next 5 years.

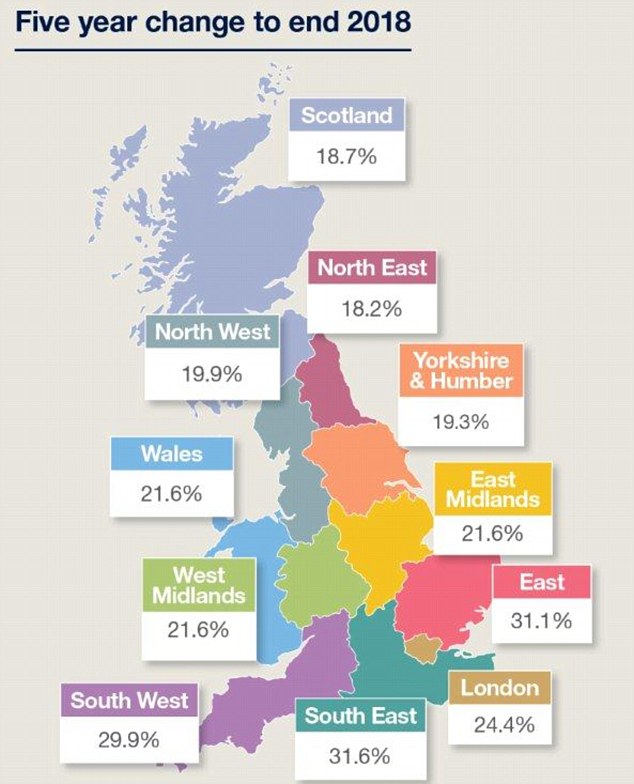

(Source: This is Money)

These figures immediately suggest two positioning strategies for savvy property investors.

Step #1 – Build up a portfolio of positive cash flow properties in low-cost areas in 2014

Whilst areas like London, South East and South West of the UK show more than an 11% price increase in 2014, many parts of the country do not.

The implication is that these other parts of the country have lower house prices, which means you’re able to build up your property portfolio without having to spend a lot of money.

So the first step is to invest in positive cash flow properties in under-valued areas of the UK in 2014.

Step #2 – Wait for prices in London to come down, and then buy properties at discount prices

Whilst you build up your portfolio of positive cash flow properties outside London/South East/South West, waitfor the prices in these places to come down. Once they do, there will be a flurry of sellers trying to off-load their properties out of fear that their real estate will lose a substantial amount of value.

But since you’ll have built-up equity and cash from your portfolio, you’ll have the financial resources to acquire these properties at great prices, knowing that they will in time go back up in value.

The future of property investment is extremely exciting. And now is the time to look at the figures and take the steps to position your portfolio so that it can benefit from the changing house prices of the future.

If you need to discuss how to finance your property portfolio, then get in touch today so we can talk you throughour commercial mortgage options.