October 2nd, 2014.

Your Ultimate Guide to Property Surveys

So you’ve found a property you want to buy and you’ve put an offer down. Now you need to have the property surveyed, but what’s the right survey to take out? This can cause a fair bit of confusion for first time buyers or people who haven’t bought a property in a while. Here’s everything you need to know about property surveys:

What are they for?

A survey is an examination carried out by a qualified surveyor, and will provide you with their detailed inspection of the property’s condition. This will let you know if you need to be worried about structural issues like weakened walls, subsidence or other major repairs or alternations that may need doing.

There are different levels of survey available that will look into the property in various depths, the types of survey are:

• Valuation Survey – the most basic check, typically carried out by the lender to ensure that the property is worth the amount they are lending against

• Condition Report – the cheapest option for surveys, this is good for newer properties as it only checks the condition of the property and provides legal advice

• Homebuyer Report – a more expensive report that gives you a market valuation, a rebuild cost and an in-depth visual condition of the property

• Structural Survey – the most extensive and expensive report that helps to identify any potential issues with the property’s structure

How much does a property survey cost?

As we touched upon briefly above, the surveys are priced differently depending on which one you choose. There will also be varying costs depending on the surveyors you choose. For rough prices, you can expect to pay:

• Nothing or a very small fee for the valuation survey – normally covered by the lender

• Condition report can cost anywhere between £100 and £250, with the cost generally being higher for larger properties

• Homebuyer reports are more expensive, ranging from £250 to £400 but provide more information and an in-depth report

• The most expensive survey is structural, with the average cost being around £1,000 but this will tell you absolutely everything about the building’s structure

What survey should I get?

This will depend largely on the property you are purchasing, taking into account the age and its current condition. The more expensive the property you are buying, the more extensive you will want the survey to be. This can help to bring up any problems and give you a much better understanding of what you’re getting into – if there are major issues you will still be able to walk away from the purchase at this point.

What do the findings mean?

When you receive your inspection, the findings will have been categorised into:

• Services

• Inside the Property

• Outside the Property

• Grounds

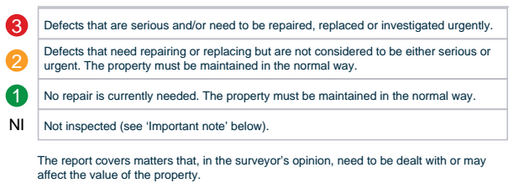

These will then delve further into the various aspects of the property and provide you with the surveyor’s analysis. Each section will then be marked in a similar manner to this:

This will be followed by a long list of the property’s features with marks next to them and a brief explanation of why they decided upon this mark. Ideally, your survey should contain mainly ones, however a handful of twos isn’t anything detrimental. When a string of threes occurs on a property you aren’t planning on extensively developing then you should probably be concerned.

In situations where threes crop up regularly it may be worth considering whether to take out a structural survey, if you had not done so previously. This will help you to be fully aware of the amount of structural work that needs to be done in the property.

Finally

Make sure you thoroughly read the survey as this is extremely important information which you need to fully understand prior to making the purchase. If you don’t fully understand the survey, ask the surveyor to explain it to you – generally they will be happy to provide you with more information on their reports.