October 6th, 2022. Mark Hughes

Why Brokers Are Now More Important Than Ever

With further turbulence forecast for both the property and finance markets, it is now more important than ever to work with an experienced and trusted specialist finance broker.

In short, the outlook for interest rates has changed. At the end of September, we saw the base rate rise to 2.25%, with many experts predicting an additional emergency interest rate hike is required to curb inflation and preserve the value of the pound.

As mainstream finance is increasingly expensive and more difficult to obtain, our whole-of-market offering and extensive knowledge of each lender’s product is invaluable.

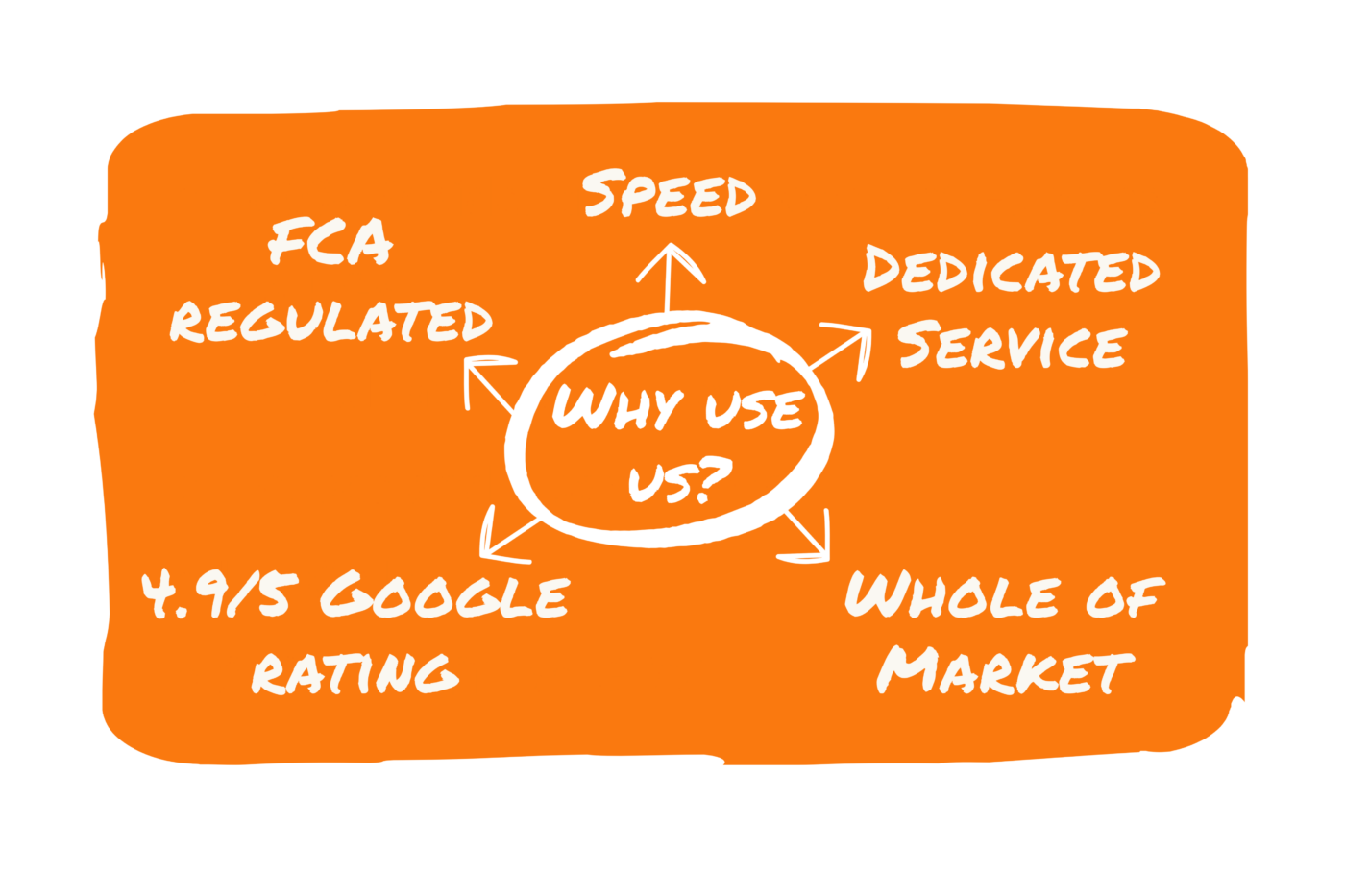

How we can help:

Speed: Timing is critical in specialist finance, so it’s key that speed forms the backbone of our service proposition

Service: From start to finish, you’ll have a dedicated account manager to package your case and put your mind to rest

Whole of market: We have a full market range of lenders that we work with, giving us the best possible chance to find the right deal for you

Compliant: As an FCA regulated brokerage, we meet all the necessary regulations

Don’t take it from us: We have a 4.9/5 rating on Google and a host of kind words to go along with it

Speak to our team regarding this, or any other of our finance options, on 02920 766 565 or request a call back here.

Article By Mark Hughes

October 6th, 2022

Mark has 15 years’ experience within the financial industry working for high street banks and specialist brokers and now focuses on Bridging finance and Second charge loans.

He would describe his style of brokering as being heavily based on knowledge and efficiency.

See more articles by Mark